Page 74 - ID - Informazioni della Difesa n. 03-2025 - Chiuso

P. 74

Molybdenum mining

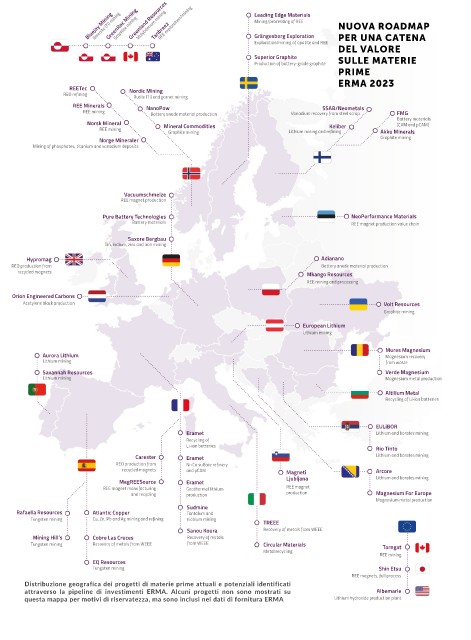

Bluejay Mining GreenRoc Mining Greenland Resources REE exploration/mining Leading Edge Materials NUOVA ROADMAP

Ilmenite (Ti) mining

Graphite mining

Mining/processing of REE

Third, a strengthened ecosystem in the fuel cell and electrolyser industry is a key component of the proposed Tanbreez Grängesberg Exploration PER UNA CATENA

actions. This will lead to measurable impact in terms of cost reduction due to reduced costs in sourcing and Exploration/mining of apatite and REE DEL VALORE

production and improved synergies that drive the R&D efforts in this sector. Staying ahead of the competition Superior Graphite SULLE MATERIE

Production of battery-grade graphite

is crucial in this emerging sector. PRIME

ERMA 2023

REETec

The alternative energy storage & conversion will benefit hugely from R&D-related actions that will translate REO refining Nordic Mining

Rutile (Ti) and garnet mining

into potentially significant GWh to TWh-scale energy storage capacities to cover the seasonal volatility of re- REE Minerals NanoPow SSAB/Neometals

newable energies and ensure strategic energy security. Decisive and timely actions in this sector have the po- REE mining Battery anode material production Vanadium recovery from steel scrap FMG

Battery materials

(CAM and pCAM)

Keliber

tential to establish Europe as a world leader in the field. Advanced materials and storage and conversion solu- Norsk Mineral Mineral Commodities Lithium mining and refining Akku Minerals

REE mining

Graphite mining

tions can furthermore lead to double-digit energy savings in the clean energy sector. Norge Mineraler Graphite mining

Mining of phosphates, titanium and vanadium deposits

While we acknowledge that the increased use of wind energy is central to the European climate goals, questions

regarding the raw materials related to wind power have been covered in previous work by ERMA in the Cluster

1 Action Plan on Rare Earth Magnets and Motors. A summary of the work can be found at the end of this Action

Vacuumschmelze

Plan. REE magnet production

Most ERMA stakeholders identified permitting as one of the most crucial bottlenecks in the development of Pure Battery Technologies NeoPerformance Materials

Battery materials

REE magnet production value chain

domestic resources and processing capacity. The uncertainty associated with the timing and outcomes of the

Saxore Bergbau

permitting process introduces a very high level of risk for potential investors, thus preventing many otherwise Tin, indium, zinc and iron mining

viable projects from being implemented. Many European countries have no time limits for environmental permit Hypromag Adianano

handling, and different aspects of permit applications are often handled by different authorities that work inde- REO production from Battery anode material production

recycled magnets

pendently. While it is absolutely crucial that that public be given the opportunity to scrutinize permit applications Mkango Resources

REE mining and processing

and appeal permit decisions, it is equally crucial that these processes be streamlined. The Critical Raw Materials Orion Engineered Carbons

Act’s intention to streamline and set a strict timeframe for permitting, in line with the recommendations made Acetylene black production Volt Resources

by the ERMA community, is a very welcome positive development. Graphite mining

European Lithium

Lithium mining

ERMA Investment pipeline Mures Magnesium

Aurora Lithium

Lithium mining Magnesium recovery

from waste

To increase Europe’s strategic autonomy in Materials for Energy Storage and Conversion, the EU will need to Savannah Resources Verde Magnesium

Lithium mining

Magnesium metal production

address the entire value chain. This involves the boosting of exploration, mining, separation, and processing and

the building of a circular economy around materials for energy storage and conversion by advancing ecodesign Altilium Metal

Recycling of Li-ion batteries

requirements, waste collection, recycling activities. Today, there is limited primary production within the EU and

for some materials related to energy storage, the EU relies almost entirely on imports. There is also a significant EULiBOR

lack of recycling facilities across Europe which, by 2050, could potentially become the main source for supplying Eramet Lithium and borates mining

Recycling of

an increasing demand for critical raw materials. Li-ion batteries Rio Tinto

Carester Eramet Lithium and borates mining

REO production from Ni-Co sulfate refinery

As of May 2023, ERMA has identified over 50 investment cases targeting materials for energy storage and recycled magnets and pCAM Magneti Arcore

conversion across Europe and beyond and a total investment need exceeding EUR 15 billion (Figure 1). If these REE magnet manufacturing Eramet Ljubljana Lithium and borates mining

MagREESource

REE magnet

Geothermal lithium

projects were realised, a significant percentage amount for some materials could be sourced from the EU by and recycling production production Magnesium For Europe

Magnesium metal production

2030, that is, significantly higher than today and, for some materials, even higher than the targets set in the Rafaella Resources Atlantic Copper Sudmine

Tantalum and

Critical Raw Materials Act. This is illustrated in Figure 2, where global and EU demand and production data for Tungsten mining Cu, Zn, Pb and Ag mining and refining niobium mining TREEE

2020 are compared with forecasted global and EU demand data for 2030 for a selected group of critical and Mining Hill’s Cobre Las Cruces Sanou Koura Recovery of metals from WEEE

Recovery of metals

strategic materials. Tungsten mining Recovery of metals from WEEE from WEEE Circular Materials Torngat

Metal recycling

REE mining

EQ Resources

Tungsten mining Shin Etsu

REE magnets, full process

Distribuzione geografica dei progetti di materie prime attuali e potenziali identificati

Figure 1. Geographic distribution of current and potential raw materials projects identified through the ERMA investment

attraverso la pipeline di investimenti ERMA. Alcuni progetti non sono mostrati su Albemarle

pipeline. Some projects are not shown on this map due to confidentiality, but are included in the ERMA supply data

questa mappa per motivi di riservatezza, ma sono inclusi nei dati di fornitura ERMA Lithium hydroxide production plant

12 reported in this document and in the high-level ERMA investment needs shown in Figures 2 and 4. 3-2025

114